Economic Development

Saturday, June 19, 2010

Posted by Anjan

Economic Planning

Friday, June 18, 2010

Posted by AnjanClassical socialists and Marxists define economic planning as directing production to maximize use-values and coordination of production, and consider this to be a fundamental element of a socialist economy. For Marxists in particular, planning also entails control of the surplus product (profit) by the associated producers in a democratic fashion.

State-oriented and technocratic socialists hold the view that in a socialist society based on economic planning, the primary function of the state apparatus will change from one of political rule over men (via the creation and enforcement of laws) into a scientific administration of things and a direction of processes of production; that is the state would become a coordinating economic entity rather than a mechanism of class or political control

Other socialists, such as Libertarian socialists, Syndicalists and democratic socialists, advocate de-centralized democratic planning. In a de-centralized planned economy, economic decision-making takes place in a democratic manner in every cooperative enterprise in the economy.

In some socialist theories, economic planning completely substitutes the market mechanism and supposedly renders monetary relations and the price system obsolete. In other theories, planning is utilized as a complement to markets. Polish economist Oskar Lange and American economist Abba Lerner proposed a form of market socialism where a central planning board would adjust prices of publicly-owned firms to equal marginal cost to enhance the market mechanism by achieving pareto efficient outcomes.

In general, the various types of socialist economic planning listed above exist as theoretical constructs that have not been implemented fully by any economy, partially because they depend on vast changes in social and economic development on a global scale . In the context of mainstream economics, socialist planning usually refers to the Soviet-type command economies, regardless of whether or not they actually constituted a type of state capitalism.

Circular Flow of Income

Wednesday, June 16, 2010

Posted by AnjanAccording to neoclassical economics, the terms circular flow of income is described as the reciprocal circulation of income between producers and consumers. In the circular flow model, the inter-dependent entities of producer and consumer are referred to as "firms" and "households" respectively and provide each other with factors in order to facilitate the flow of income. Firms provide consumers with goods and services in exchange for consumer expenditure and "factors of production" from households. The circular flow model has been criticized by ecological economists for failing to show that the economy has a physical root in its larger environment, and hence for being at the root of the neoclassical models' inability to conceptualize effectively environmental constraints and costs, such as global climate change and the loss of ecosystem services that leads to uneconomic growth. Economists advancing this idea include Herman Daly; Joshua Farley; Robert Costanza; and political theorist Eric Zencey .

The circle of money flowing through the economy is as follows: total income is spent (with the exception of "leakages" such as consumer saving), while that expenditure allows the sale of goods and services, which in turn allows the payment of income (such as wages and salaries). Expenditure based on borrowings and existing  wealth – i.e., "injections" such as fixed investment – can add to total spending.

wealth – i.e., "injections" such as fixed investment – can add to total spending.

In equilibrium, leakages equal injections and the circular flow stays the same size. If injections exceed leakages, the circular flow grows (i.e., there is economic prosperity), while if they are less than leakages, the circular flow shrinks (i.e., there is a recession).

More complete and realistic circular flow models are more complex. They would explicitly include the roles of government and financial markets, along with imports and exports. To the extent that they remain circular flow models, however, they do not effectively model the one-way flow of energy through the economy. (That energy flow must be one-way and not a circular flow is a consequence of the second law of thermodynamics, the law of entropy. This failure ultimately allows neoclassical models to treat environmental values as a subcategory of economic values, rather than seeing economic activity em placed as a subcategory of human activity which in turn is a subcategory of activity within ecosystems.

Labor and other "factors of production" supplied by households are sold on resource markets. These resources, purchased by firms, are then used to produce goods and services. The latter are sold on product markets, ending up in the hands of the households, helping them to supply resources. Again, critics say that it is unrealistic and dysfunctional to model the economy as if energy and other resources were extracted from households instead of planetary systems. This criticism is further elaborated within an article in the Encyclopedia of Earth .

Inflation and Monetary Policy

Monday, June 14, 2010

Posted by AnjanIn my opinion,in most price system economies, money is a means of final payment for goods and also money can be defined as the unit of account in which prices are typically stated. It includes currency held by the non bank public and check able deposits. It has been described as a social convention, like language, useful to one largely because it is useful to others. Nowadays, it becomes very useful for us. Without money, it is very difficult to exchange goods.

Money facilitates trade as a medium of exchange. Its economic function can be contrasted with barter (non-monetary exchange). Given a diverse array of produced goods and specialized producers, barter may entail a hard-to-locate double coincidence of wants as to what is exchanged, say apples and a book. Money can reduce the transaction cost of exchange because of its ready acceptability. Then it is less costly for the seller to accept money in exchange, rather than what the buyer produces.

At the level of an economy, theory and evidence are consistent with a positive relationship running from the total money supply to the nominal value of total output and to the general price level. For this reason, management of the money supply is a key aspect of monetary policy.

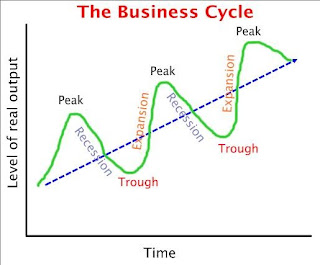

The Business Cycle

Posted by Anjan

The term business cycle refers to economy-wide fluctuations economic activity over several months or years. These fluctuations occur around a long-term growth trend, and typically involve shifts over time between periods of relatively rapid economic growth and periods of relative stagnation or decline.

These fluctuations are often measured using the growth rate of real gross domestic product. Despite being termed cycles, most of these fluctuations in economic activity do not follow a mechanical or predictable periodic pattern.

The economics of a depression were the spur for the creation of "macroeconomics" as a separate discipline field of study. During the Great Depression of the 1930s, John Maynard Keynes authored a book entitled The General Theory of Employment, Interest and Money outlining the key theories of Keynesian economics. Keynes contended that aggregate demand for goods might be insufficient during economic downturns, leading to unnecessarily high unemployment and losses of potential output.He therefore advocated active policy responses by the public sector, including monetary policy actions by the central bank and fiscal policy actions by the government to stabilize output over the business cycle Thus, a central conclusion of Keynesian economics is that, in some situations, no strong automatic mechanism moves output and employment towards full employment levels. John Hicks' IS/LM model has been the most influential interpretation of The General Theory.

Over the years, the understanding of the business cycle has branched into various schools, related to or opposed to Keynesianism. The neoclassical synthesis refers to the reconciliation of Keynesian economics with neoclassical economics, stating that Keynesianism is correct in the short run, with the economy following neoclassical theory in the long run.

The New classical school critiques the Keynesian view of the business cycle. It includes Friedman's permanent income hypothesis view on consumption, the "rational expectations revolution" spearheaded by Robert Lucas, and real business cycle theory.

In contrast, the New Keynesian school retains the rational expectations assumption, however it assumes a variety of market failures. In particular, New Keynesians assume prices and wages are "sticky", which means they do not adjust instantaneously to changes in economic conditions.

Growth in Economics

Posted by Anjan

Growth means increase in some quantity over time. The quantity can be physical(growth in an amount of money,growth in height) and abstract (a system becoming more complex, an organism becoming more mature).

It can also refer to the mode of growth, i.e. numeric models for describing how much a particular quantity grows over time. Growth economics studies those factors which explain economic growth – the increase in output per capita of a country over a long period of time. The same factors are used to explain differences in the level of output per capita between countries, in particular why some countries grow faster than others, and whether countries converge at the same rates of growth.

Much-studied factors include the rate of investment, population growth, and technological change. These are represented in theoretical and empirical forms (as in the neoclassical and endogenous growth models) and in growth accounting.Macroeconomics

Posted by Anjan

Macroeconomics study aggregated indicators . It studies the economy as a whole to explain broad aggregates and their interactions "top down," that is, using a simplified form of general-equilibrium theory. Such aggregates include national income and output, the unemployment rate, and price inflation and subaggregates like total consumption and investment spending and their components. It also studies effects of monetary policy and fiscal policy.

Since at least the 1960s, macroeconomics has been characterized by further integration as to micro-based modeling of sectors, including rationality of players, efficient use of market information, and imperfect competition. This has addressed a long-standing concern about inconsistent developments of the same subject.

Macroeconomic analysis also considers factors affecting the long-term level and growth of national income. Such factors include capital accumulation, technological change and labor force growth.