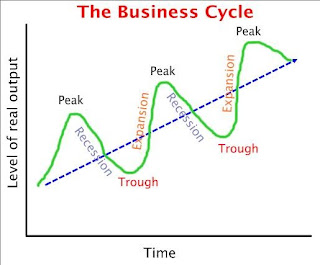

The term business cycle refers to economy-wide fluctuations economic activity over several months or years. These fluctuations occur around a long-term growth trend, and typically involve shifts over time between periods of relatively rapid economic growth and periods of relative stagnation or decline.

These fluctuations are often measured using the growth rate of real gross domestic product. Despite being termed cycles, most of these fluctuations in economic activity do not follow a mechanical or predictable periodic pattern.

The economics of a depression were the spur for the creation of "macroeconomics" as a separate discipline field of study. During the Great Depression of the 1930s, John Maynard Keynes authored a book entitled The General Theory of Employment, Interest and Money outlining the key theories of Keynesian economics. Keynes contended that aggregate demand for goods might be insufficient during economic downturns, leading to unnecessarily high unemployment and losses of potential output.He therefore advocated active policy responses by the public sector, including monetary policy actions by the central bank and fiscal policy actions by the government to stabilize output over the business cycle Thus, a central conclusion of Keynesian economics is that, in some situations, no strong automatic mechanism moves output and employment towards full employment levels. John Hicks' IS/LM model has been the most influential interpretation of The General Theory.

Over the years, the understanding of the business cycle has branched into various schools, related to or opposed to Keynesianism. The neoclassical synthesis refers to the reconciliation of Keynesian economics with neoclassical economics, stating that Keynesianism is correct in the short run, with the economy following neoclassical theory in the long run.

The New classical school critiques the Keynesian view of the business cycle. It includes Friedman's permanent income hypothesis view on consumption, the "rational expectations revolution" spearheaded by Robert Lucas, and real business cycle theory.

In contrast, the New Keynesian school retains the rational expectations assumption, however it assumes a variety of market failures. In particular, New Keynesians assume prices and wages are "sticky", which means they do not adjust instantaneously to changes in economic conditions.

Thus, the new classicals assume that prices and wages adjust automatically to attain full employment, whereas the new Keynesians see full employment as being automatically achieved only in the long run, and hence government and central-bank policies are needed because the "long run" may be very long.

0 comments:

Post a Comment